What Does The Wallace Insurance Agency Do?

Below are 7 reasons why insurance coverage is very important. What a lot more would certainly you include? In the days after the 9/11 strikes, there were many bother with insurance policy coverage. Was an act of battle? The huge inquiry was, Thankfully, the insurance market determined the strikes were not an act of war. Nonetheless, after 9/11, some insurers began leaving out terrorism.

The Wallace Insurance Agency - Truths

In this instance, insurance policy most likely avoided lots of organizations from preventing terrorist-targeted operations, such as refineries and chemical haulers. This reason is connected to No. 1. Lenders need that you have insurance. Think of it: Home loan lending institutions want evidence of insurance prior to you get or build a new building. Simply put,, it's most likely you appreciate the benefits of insurance policy.

An Unbiased View of The Wallace Insurance Agency

Business owners can take on certain organization ventures because they can many thanks to insurance policy. Insurance is the called for (by lending institutions) safety and security internet that.

This reason why insurance coverage is crucial dovetails nicely with tranquility of mind (No. 4). It all goes back to the concept that insurance policy, when triggered, makes policyholders whole once more.

Top Guidelines Of The Wallace Insurance Agency

If sufficient little individuals leave the market (and one huge person swallows them up), you're left with a monopoly. With insurance, however, the little people have support if they want to take a threat, which implies they stick around much longer.

A serious instance of insurance coverage in action is the West Plant food Co. surge in Texas this spring. The surge did $100 million in damages to the area, consisting of institutions and hospitals. The fertilizer company had only $1 million in general liability protection. Currently the city is taking legal action against West Plant food and likely will win every one of the business's continuing to be property and possessions that were not harmed by the disaster.

Not known Incorrect Statements About The Wallace Insurance Agency

What's even more is the city additionally is taking legal action against the suppliers to the fertilizer plant, asserting they recognized they were providing naturally unsafe materials. In the case of the West, Texas, plant surge, insurance policy might have assisted. Insurance is something several organization owners do not intend to think of. But whether they consider insurance, with hope it's there, enabling transfer of risk and providing a safety and security net for new possibilities.

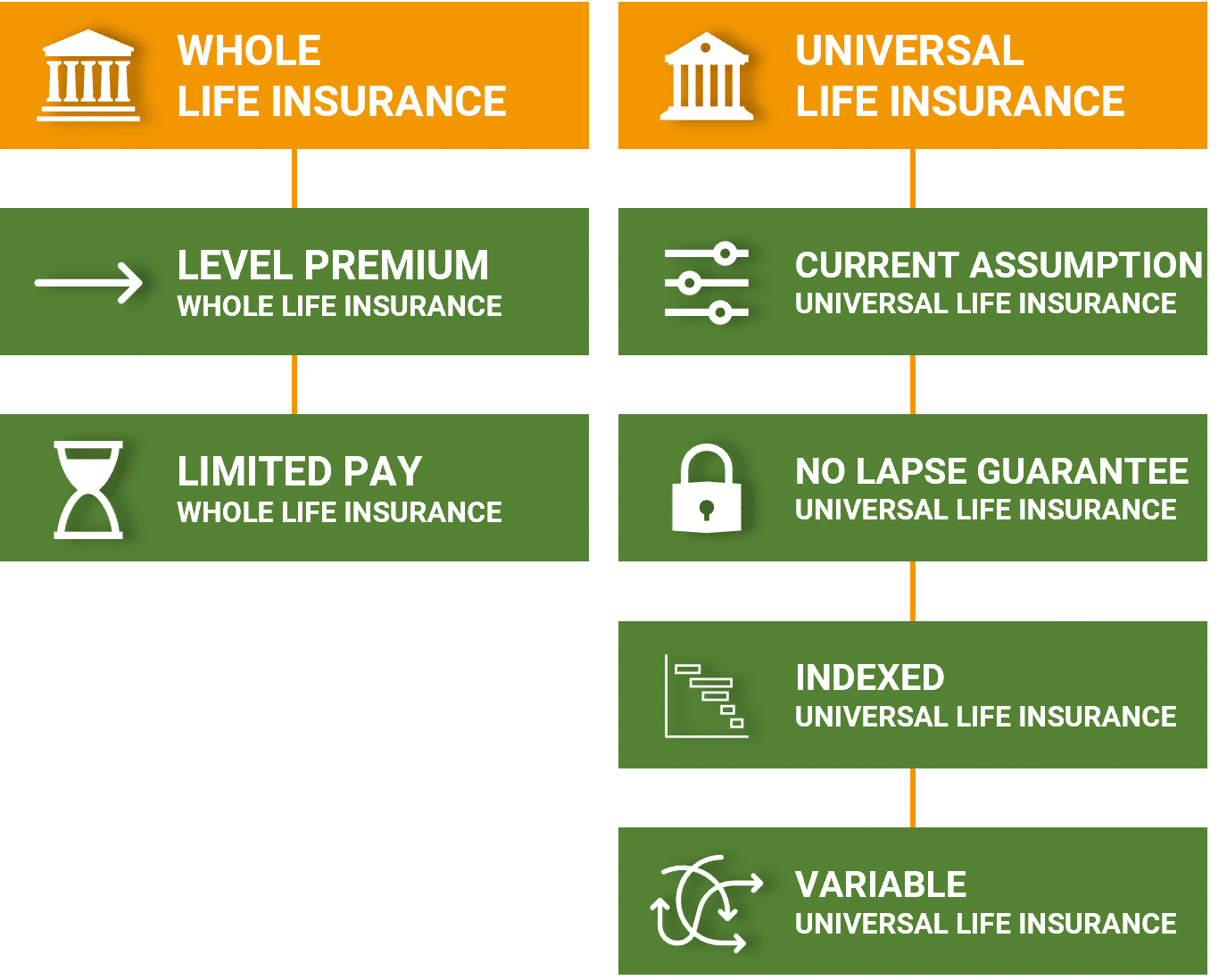

Identify your objectives, establish just how much insurance policy you require to fulfill your objectives gradually, and identify what you can afford to pay. Learn what kinds of insurance policy can aid you satisfy your demands. After thinking about preliminary costs settlements, any kind of possible rises in costs over time, any kind of extra fatality advantages,1 and any living benefits2 that can be made use of prior to you die, pick the kind of insurance coverage (or combination of kinds) that ideal fulfills your demands.

The Wallace Insurance Agency Things To Know Before You Buy

Several of the most common factors for getting life insurance coverage include: 1. Guaranteed security, If you have a family, a company, or others that depend upon you, the life insurance benefit of an entire Recommended Site life policy acts as a monetary safety net. When you die, your beneficiaries will obtain a lump-sum payment that is assured to be paid in complete (provided all premiums are paid and there are no outstanding fundings).

Indicators on The Wallace Insurance Agency You Should Know

- Income substitute, Picture what would happen to your household if the income you supply all of a sudden gone away. With entire life insurance policy, you can assist make certain that your enjoyed ones have the cash they need to assist: Pay the mortgage Afford childcare, healthcare, or other services Cover tuition or various other college costs Remove home debt Protect a household company 3.

That's due to the fact that the advantage of a life insurance coverage policy is usually passed along federal earnings free of tax. 4 - https://www.openlearning.com/u/robertkroll-s44a92/. Guaranteed money value development, As you pay your premiums, your Whole Life plan develops cash value that is ensured to growtax deferredand can aid meet a selection of monetary objectives: Supplement retired life earnings Fund a kid or grandchild's education Pay off a home mortgage Protect existing possessions Develop a reserve 5

Indicators on The Wallace Insurance Agency You Need To Know

4 Although they are not guaranteed, when returns are awarded, you can take them in money, utilize them to offset your premiums, or utilize them to purchase paid-up added insurance policy that increases your coverage and money worth, use them to offset your premiums, or take them in cash money. 6. Optional riders, There are numerous ways to customize an entire life policy to satisfy your individual requirements.

Your agent can aid you make a decision if any of these motorcyclists are best for you.